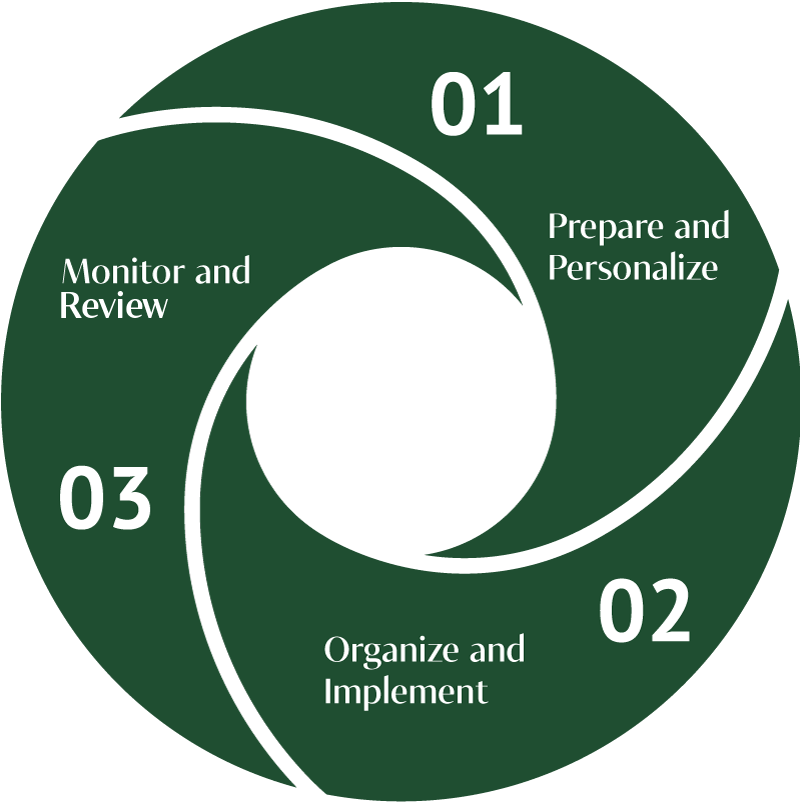

Our Approach

Our approach integrates merit-based investment strategies with financial advice to help you unlock your wealth’s potential. We’ve developed a pragmatic framework that helps you build a solid foundation as we identify opportunities for growth. By creating custom remedies with an elevated standard of care, our firm strives to lead you to greater levels of financial strength and success.

Step 1: Prepare and Personalize

- Personalize: It's important for your financial plan and process to suit your individual needs, goals and risk tolerance, so our first priority is getting to know you. We take time to discover exactly what success looks like to you before recommending a specific direction.

- Align: We consider the psychology of finance alongside the fundamental and technical aspects. Working with a clear understanding of your financial personality enables us to fine-tune our strategies to deliver solutions that are aligned with your vision of success.

- Prioritize: Life is precious, and we need to make sure your time and money is invested where you need it to be. We help you prioritize your goals and objectives so we can plan accordingly.

Step 2: Organize and Implement

- Identify: In this step of the process, we identify the opportunities available to you and provide wisdom so you can make informed planning decisions.

- Implement: Then, we work with you to implement integrated solutions that maximize your wealth, preserve your assets and help you prepare for the future—legacy included.

- Guide: With Key Sage, you’re never on your own. We check in with you frequently, help you understand your strategies and options and lead you proactively toward your goals.

- Anticipate: In finance (and in life), everything can change on a dime. We stay in tune with current events, trends, and your personal life so we can recommend adjustments to your strategies when the time is ripe.

Step 3: Monitor and Review

- Monitor: As time passes, your life changes, and so does the world around you—your priorities, goals, needs, risk tolerance; the economy and financial markets, social norms. So, we make sure your financial plan is fluid, flexible and regularly updated accordingly.

- Review: We look beyond basic strategies and integrate every part of your financial life—whether you need guidance for alternative investments, real estate, or business planning.

- Avialabilty: Our work together is a true partnership, and we intend to guide you through every season of life. Whether you have a simple question or want advice on a major financial decision, we’ll be here with common-sense strategies and honest feedback that help you unlock your greatest potential.